Real Estate News

Radon in Canadian Homes: What Homeowners Need to Know

When we think about risks inside our homes, things like mould, carbon monoxide, or faulty wiring often come to mind. One hazard that gets far less attention - but deserves it - is radon gas.

Radon is a naturally occurring radioactive gas that comes from the breakdown of uranium in soil and rock. It’s invisible, odourless, and tasteless, which means it can build up inside homes without homeowners ever knowing it’s there.

According to Health Canada, radon is the second leading cause of lung cancer after smoking, and the leading cause among non-smokers. Recent reporting by CBC News has brought renewed attention to how common radon exposure is in Canadian homes - and how preventable the risk can be.

👉 Read the original CBC article here:

https://www.cbc.ca/news/health/radon-home-mitigation-9.7063662

Why Radon Is a Canadian Issue

Radon exists everywhere, but Canada’s geology and climate make it particularly relevant here. Because we spend a large portion of the year indoors with windows closed, radon can accumulate to higher levels, especially in:

- Homes with basements

- Older homes with foundation cracks

- Well-sealed, energy-efficient houses

- Certain regions with higher natural uranium levels

How Radon Gets Into a Home

Radon enters through small openings where the house meets the ground, including:

- Foundation cracks

- Gaps around pipes and sump pumps

- Floor drains

- Construction joints

Testing: Simple, Affordable, and Essential

One of the most reassuring things about radon is that testing is easy. Long-term test kits are inexpensive, widely available, and can be done by homeowners without professional help.

Health Canada recommends:

- Testing for at least 3 months

- During the heating season (fall to spring)

- On the lowest lived-in level of the home

Mitigation: A Fixable Problem

If high radon levels are found, the good news is that mitigation is both effective and proven. The most common solution is an active soil depressurization system, which involves:

- Installing a pipe through the foundation

- Using a fan to vent radon safely outside

Why This Matters for Homeowners and Buyers

Radon awareness is growing across Canada, and it’s increasingly part of conversations around:

- Home maintenance

- Renovations

- Real estate transactions

The Bottom Line

Radon isn’t something to panic about, but it is something to take seriously. It’s common, it’s invisible, and it’s measurable. Most importantly, it’s fixable.

Testing your home is one of the simplest steps you can take to protect the long-term health of everyone living there.

If you’ve never tested your home - or if it’s been years since you last did - now is a great time to put it on your home-care checklist.

Ontario Real Estate rocked by iPro trust account scandal - What you need to know.

In 2025, one of Ontario’s largest real estate brokerages - iPro Realty Ltd. - abruptly collapsed after regulators found millions of dollars missing from its trust accounts, sending shockwaves through the industry and shaking consumer confidence in how deposits and commissions are protected.

What Happened?

In May 2025, the Real Estate Council of Ontario (RECO) discovered a significant shortfall in iPro’s trust accounts - money that should have been held safely for consumer deposits and agent commissions.

These trust accounts are legally required to be separate from a brokerage’s business accounts - they hold deposits from homebuyers and money owed to Realtors until closing.

Instead of immediately freezing the accounts or alerting the public, RECO waited months before ordering iPro to close and freeze the accounts - a delay that drew strong criticism.

When the brokerage shut down on August 19, 2025, it emerged that more than $8-10 million was missing. Lawsuits later suggested even larger sums may have been diverted to related businesses and individuals connected to iPro’s leadership.

Who’s Affected?

Homebuyers and sellers with deposits held by iPro were left worried about whether their money was safe.

Around 2,400 agents suddenly had to find new brokerages and deal with unpaid commissions.

Trust in the real estate system took a hit, raising questions about how well consumers are protected in one of the biggest financial transactions they’ll ever make.

Why it Matters

This isn’t just about one company - it exposed gaps in regulatory oversight and showed that even large brokerage trust accounts can be vulnerable. In this case:

- Funds legally meant to be held in trust were allegedly moved into operating accounts or used for purposes they shouldn’t be.

- The incident highlighted weaknesses in how often or how deeply regulators inspect trust accounts.

What’s Being Done Now

Regulatory and government responses are underway to restore confidence and tighten oversight:

- Trust accounts were frozen and an independent audit was launched to trace the missing funds.

- The Ontario Provincial Police has launched an investigation into the matter.

- RECO’s former registrar was removed amid criticism of how the scandal was handled.

- The Ontario government is considering appointing an administrator to oversee RECO, a rare step aimed at restoring public trust in the regulator itself.

- Payouts for unpaid agent commissions are being processed, though amounts may be limited (e.g., many agents may receive about 50% of what’s owed through insurance programs so far).

- RECO also revised settlement contract language after Realtor feedback to clarify rights and avoid clauses that could limit future claims.

What This Means For You

If you’re buying or selling:

- Deposits are still protected by trust account rules and insurance, but this case shows why it’s important to work with well-regulated brokerages and understand how your money is held.

- Ask questions if you’re unsure where your deposit is held and verify your agent and brokerage are in good standing with RECO.

This incident may lead to stronger oversight and tighter rules on managing and auditing trust accounts, which should benefit all buyers and sellers in future.

To Buy or Not to Buy?

In 2025, Ontario’s housing market looks very different from the sharp sprint it ran through much of the early 2020s. Instead of bidding wars and rapid price growth with every home, the market has slowed, sellers are more flexible, and many buyers are waiting on the sidelines. But that hesitation isn’t without consequences - especially for renters or future homeowners watching from the wings.

🤔 Why Buyers Are Staying on the Sidelines

Several factors are influencing buyer behaviour in Ontario:

Economic and Confidence Uncertainty

Economic headwinds - including broader global trade tensions and concern about Canada’s economic future - have shaken buyer confidence. Many prospective buyers are adopting a “wait and see” mindset, especially with talk of recession risk and job security top of mind. Surveys show a majority of Canadians are holding off until they see clearer economic stability or further interest rate reductions.

Affordability Pressures Still Bite

Although borrowing costs have come down from peak levels, Ontario home prices remain high relative to incomes, especially in the Greater Toronto Area and other popular cities. High living costs, debt levels and the challenge of saving a substantial down payment continue to put homeownership out of reach for many first-time buyers.

Buyers Expect Prices to Fall Further

A common refrain is: “Why buy today if prices might be lower tomorrow?” This expectation - that home prices could decline further before stabilizing - has kept many would-be buyers on pause. In fact, price softening and expanding inventory have created more balanced conditions, but also reinforced the narrative of a market that will keep sliding.

Inventory Growth Gives Buyers Less Urgency

Record levels of active listings in many Ontario markets have shifted negotiating power toward buyers. With more choices and less competition than in recent years, potential buyers feel that they can take their time - and perhaps wait for even better deals.

📈 So Why Buy Now Instead of Waiting?

While hesitation is understandable, especially for first-timers, there are several reasons why acting now - or at least preparing to act - may be a smart move:

✔ Improved Negotiating Power

Nearly everywhere in Ontario, buyers now have more leverage than in the last decade. Homes are staying on the market longer, and sellers are increasingly willing to negotiate on price and conditions. That could translate into lower purchase prices, more favourable terms, and greater control over closing timelines.

✔ Lower Borrowing Costs Than in Recent Years

After the period of historically high interest rates, the Bank of Canada’s cuts have brought mortgage rates down to more manageable levels compared with 2023-2024. That softening makes monthly payments more affordable - which matters almost as much as the purchase price itself.

✔ Delay Can Increase Costs in the Long Run

Renting while waiting may feel less risky today, but rents - albeit cooling - still represent ongoing costs with no equity return. Over the long term, owning a property can build wealth through accumulated equity, especially if prices begin to rebound as many experts expect by 2026.

✔ Demographics Still Support Long-Term Demand

Ontario remains a top destination for new Canadians and internal migrants alike. While immigration adjustments have affected short-term demand, the long-term trajectory of population growth supports stronger housing demand over time - which can help property values in future years.

🏡 What This Means for You

👉 Renters:

If you’re planning to transition from renting to owning, now can be a strategic time to get pre-approved and watch opportunities closely, rather than chasing a future “bottom.” Building equity can be a faster path to financial stability than long-term renting.

👉 First-Time Home Buyers:

With more supply and improved negotiating conditions, today’s market could make it easier to find a property that meets your needs - without the frenzy of multiple offers that characterized recent years.

👉 Buyers Waiting for Rates to Drop Further:

Rates may soften marginally, but waiting purely for rate cuts could mean missing out on current pricing and selections - especially if broader economic forces stabilize and prices stall or tick upward. Additionally, a rate cut could mean a lot less to the bottom line than you realize. Consult with a mortgage specialist to discuss what a change in mortgage rates works out to in dollars and cents.

Bottom Line: Ontario’s housing market feels slow right now largely because buyers are uncertain. But that very uncertainty is what’s creating favourable conditions for those ready to act strategically. With the right preparation and market guidance, buying today - rather than waiting - can be both a financially and personally rewarding decision.

Power of Sale - Shopping for Bargain Homes

Are Power of Sale Homes Really a Deal in Ontario?

If you follow housing news or scroll through listings, you may have seen the term “Power of Sale” pop up and thought, “Here’s my chance to get a bargain!” It’s a common reaction — especially for buyers who’ve watched U.S. real estate shows where foreclosures sell for a fraction of market value.

But in Ontario, things work differently. Power of Sale properties are not the same as U.S.-style foreclosures, and the “great deal” many buyers imagine often doesn’t exist.

Here’s what’s really going on behind those listings.

What Is a Power of Sale?

A Power of Sale happens when a homeowner falls behind on their mortgage and the lender steps in to sell the home in order to recover the money owed. The key point: the lender doesn’t actually own the property — they’re simply acting on behalf of the borrower to settle the debt.

Any money left over after the mortgage and fees are paid goes back to the homeowner, not the bank. That’s a major difference from a foreclosure, where the lender takes ownership and can sell for whatever they like, keeping any profit.

Because of this, Canadian lenders are legally obligated to sell the home for fair market value, not a deep discount.

Why “Power of Sale Deals” Are Rare

In the U.S., foreclosure homes can sit vacant, be auctioned off, or sell for far below market value. That’s not the case here.

In Ontario, lenders usually:

- Hire real estate agents to list the home on MLS at current market value.

- Get professional appraisals to ensure the price reflects true market conditions.

- Are required to show they’ve made a good-faith effort to sell fairly.

That doesn’t mean there’s never an opportunity, but “steals” are extremely rare.

Why People Are Talking About Them More Lately

There’s growing concern that Power of Sale listings may increase in 2025 as homeowners renew their mortgages at much higher rates.

Some borrowers - especially those with variable-rate mortgages or heavy consumer debt - are struggling to keep up.

Even so, Canada’s banking system is conservative by design:

- Borrowers must pass the mortgage stress test, meaning they qualified at a higher rate than they pay.

- Lenders generally work with homeowners to find solutions long before a Power of Sale happens.

What Buyers Should Know

If you’re looking at a Power of Sale property:

- Expect to buy it as-is, often with limited information about the home’s condition.

- Be ready for a stricter purchase process, since the seller (the lender) won’t negotiate emotional or over cosmetic factors.

- Work with a real estate professional who understands the specific clauses and timelines involved.

Home Equity Sharing Agreements - Easy Money Mortgage or Financial Trap?

There is a new kind of mortgage alternative making its way into Canada, modelled on structures more common elsewhere: home equity sharing agreements (sometimes called shared appreciation agreements, home equity investments, or equity-sharing mortgages). Under these arrangements:

- A homeowner receives cash today, drawn from the equity in their home.

- In exchange, the homeowner agrees to share a portion of the future appreciation of the home (the increase in its value) with the investor or firm providing the cash.

- There is typically no traditional monthly interest payment. Instead, the cost is “paid” via the share of value the investor claims later, when the home is sold (or at the end of a contract period).

- Over time, especially in a rising real estate market, the investor’s share can become quite large - so the homeowner may end up giving up more than what seems reasonable at first glance.

Key Risks, Traps, and Warning Signs

There are several red flags and fine-print issues people should scrutinize before entering such a deal.

| Issue | What to watch out for | Why it matters |

| Appraisal discount / valuation bias | The investor might value your home conservatively (or lowball) to protect its downside - which means your “share” is predicated on a lower base. | You could end up owing more relative to your real gain than you would expect. |

| High effective rate / implicit cost | Even though there’s no stated interest rate, the return the investor demands (in share of appreciation) can equivalently be extremely high. | In some cases, it might exceed what you’d pay with a high-interest HELOC or refinancing. |

| Balloon or lump-sum payoff required | At the end of term or upon sale, you may need to pay a sizeable lump sum (your advance + the investor’s share). | If you don’t have the funds, you might be forced to sell your home or refinance under unfavourable terms. |

| Term, exit rights, and sale triggers | Contracts may limit how long you hold the agreement, mandate a sale or payoff after some years, or have penalties if you exit early. | Your flexibility is constrained; you could be locked in or facing penalties if you try to renegotiate. |

| Costs, fees, and closing charges | These agreements often carry extra upfront costs: appraisal, legal, origination or structuring fees, title insurance, etc. | These fees reduce the net proceeds you actually receive. |

| Market risk / downside protection | What happens if your home value stagnates or falls? How is depreciation handled? | You might still owe more than anticipated or share “phantom appreciation” if not structured fairly. |

| Impact on future borrowing / refinance options | The equity sharing deal may restrict your ability to refinance or take other secured borrowing on the home. | It could limit your choices later, especially if you want to replace your mortgage or tap more equity. |

| Transparency of formulas and terms | The precise formula by which the appreciation share is calculated (gross vs net, base value, thresholds, caps) must be crystal clear. | Ambiguity enables the investor to interpret in their favour. |

| Tax and estate implications | How is the payout treated for tax purposes? What happens if you die, or pass it to heirs? | Surprises could arise in capital gains, estate settlement, or required payoff obligations. |

What Homeowners Should Do (Due Diligence)

If you - or someone you know - is considering one of these equity-sharing agreements, here’s a checklist and approach:

- Read every clause carefully — especially those about valuation, exit, penalties, and formulas for the share.

- Simulate scenarios — do “what if” comparisons: modest appreciation, steep appreciation, depreciation. See how much you might owe under each.

- Compare with conventional alternatives — e.g. HELOC, second mortgage, refinancing. Even if you can’t qualify for some, see how the costs stack up.

- Confirm your right to refinance — make sure the agreement does not block you from later refinancing or restructuring your mortgage.

- Understand the timing & term — how long is the agreement? When is payoff due? What are your options to exit early?

- Negotiate valuation basis — try to get fair or independent appraisal terms, or mechanisms such as averaging or third-party verification.

- Watch fees & costs — ask for full disclosure of all upfront and ongoing fees. Know how much you actually get net of costs.

- Consult professionals — a real estate lawyer and financial advisor should review the terms.

- Assess risk tolerance & market trajectory — if your local housing market is volatile or uncertain, the risk of overpaying increases.

- Estate & tax planning — understand what happens in your will, or if you pass on the property; ensure heirs are not trapped by steep obligations.

Bottom Line

Home equity sharing agreements look appealing on the surface - “instant cash, no interest payments, no monthly burden” - but their downside can be steep, especially when the fine print kicks in. They are essentially betting on your home’s value rising, and if that bet lands in the investor’s favour, you may pay a heavy price for the convenience.

The Great Condo "Collapse"

Over the past year, Ontario’s condo market - especially in Greater Toronto - has clearly shifted. From booming demand, rapidly rising prices and speculative pre-construction purchases, we’ve moved into a period of cooling, oversupply, and price corrections. Some commentators call this a collapse of the condo market. Whether or not “collapse” is the right word, the changes are real - and they carry important implications.

What’s Going On: Key Drivers

Here are the main forces reshaping the condo market in Ontario:

Interest Rate Hikes

Since 2022, the Bank of Canada has raised interest rates significantly. That makes borrowing more expensive, which increases mortgage payments, and also reduces what some buyers can qualify for. Financing pre-construction projects or assignment contracts is harder.

Oversupply / High Inventory

A huge number of condos have been built, are under construction, or were pre-sold years ago. Many units are now complete (or near completion) but unsold. In some areas, inventory is rising fast.

Speculative Purchasing & Assignment Sales

Many buyers in recent years bought condos before they were built (pre-construction), sometimes with the expectation of flipping via assignment (selling the purchase contract before closing). Those strategies assumed continued rapid appreciation, but now many find themselves in contracts where the market value (or appraisal) is less than what they agreed to pay. That creates losses, financing gaps, or hard decisions.

Declining Demand from Investors

Rising costs (interest, maintenance/condo fees, taxes), lower returns, and softened rental markets are causing many investors to pull back or exit.

Rising Carrying Costs

Even for owners who bought and are living in their condo, or those renting out, there are increasing demands: maintenance fees, special assessments, rising insurance, property taxes, utilities - these escalate over time and may not be fully predictable at purchase.

What It Means for Current Condo Owners

If you already own a condo in Ontario (whether as a primary home or investment), here are the consequences and what to watch out for:

Pros / Opportunities

- Better Bargaining Power: Sellers may need to be more realistic on pricing. If you're staying, this means less upward pressure on fees or resale competition (for now).

- Potential Price Stabilization: After the drop, there may be fewer sudden fluctuations. For long-term owners, this may reduce downside volatility.

- Rental Demand Might Remain Strong: In desirable locations, renting is still an option; if vacancy rates stay tight, rent may increase (though not uniformly).

Risks and Challenges

- Negative Equity Risks: Those who bought at peak prices (especially through pre-construction or assignment) now may see that the market value is below their purchase price. If you need to sell, you may incur losses.

- Higher Carrying and Maintenance Costs: Special assessments can arise when condo corporations need to fix deferred maintenance or unexpected costs—owners collectively bear these. Inflation and supply-chain issues make repairs and materials costlier.

- Mortgage Renewal Risk: If you need to refinance or renew a mortgage, higher rates may increase costs significantly. For investors especially, this can squeeze cash flow.

- Slower Resale Markets: It might take longer to sell, and you may have to accept lower margins.

What It Means for Prospective Condo Buyers

If you’re considering buying a condo now or in the near future, there are both potential advantages - and pitfalls.

Advantages

- More Choice & Negotiating Room: With sales slowing and inventory high, buyers may have more units to choose from and better leverage in negotiations.

- Potentially Lower Prices / Discounts: Pre-construction and resale units may be priced more conservatively now; some assignment contracts may be sold at a loss by their owners, opening up opportunity for savvy buyers. Deeded+2Urbaneer+2

- Opportunity for Long-Term Value: If you plan to live in your condo for many years, you may benefit from eventual market recovery, provided you can handle the near-term costs.

Risks / Things to Be Careful About

- Assess True Costs: Beyond mortgage payments, there are condo fees, property taxes, utilities, maintenance, and possibly special assessments. Be very conservative in estimating these.

- Appraisal / Financing Gaps: The value of a condo when it is finished or re-sold may be less than what was agreed upon in contract. Lenders may appraise lower, meaning you might need more down payment than expected. Urbaneer+2Deeded+2

- Assignment Contracts Complexity: If buying pre-construction, understand whether assignment is allowed, what fees are involved, what developer rules apply, and what happens if the buyer doesn’t or can’t close. The legal and financial consequences can be serious.

- Market Timing Risk: Buying now means you could face a period where the market declines further before recovering. If you need to sell in a few years, you may not see gains.

- Risk of Developer Distress: Some projects have been delayed, cancelled, or converted (e.g. from condo to rental), which can affect delivery timelines, finishes, or even financial claims.

What to Do: Tips & Strategies

For both current owners and buyers, certain strategies can help navigate these choppy waters:

- Run the Numbers Conservatively

- Build in “worst-case” scenarios: higher interest rates, fees, unexpected assessments. Always have a buffer.

- Inspect Condo Corporation Health

- For existing buildings: review reserve funds, deferred maintenance, histories of special assessments. For pre-construction, examine the reputation and track record of the developer.

- Understand the Contract Inside Out

- Especially with pre-construction or assignment deals: know your rights, responsibilities, what happens if appraisals come in low, and what happens if you can’t close (or want to exit). Get good legal advice.

- Consider Waiting or Buying Used / Resale

- If you’re not in a rush, resale condos may offer more predictable costs, immediate occupancy, and fewer risks compared to pre-construction units.

- Location & Quality Still Matter

- A well-built condo in a desirable location with good transit access, amenities, and strong management will weather downturns better.

- Plan for the Long Term

- Real estate is cyclical. If you can hold for longer and aren’t stretched financially, buying during a dip can be advantageous.

Big Picture: What This Means for the Market & Policy

Beyond individual owners and buyers, this condo market correction has implications for urban planning and policy in Ontario:

- It highlights an imbalance between what was built (lots of small “speculative” condos) versus what many people need (more family-friendly units, low-rise homes, townhouses) and what is sustainable.

- It may slow construction starts for condos, contributing to future supply gaps, especially in certain sectors.

- Policymakers may need to revisit rules around pre-construction contracts, developer accountability, disclosure, assignment sales, transparency, and reserve-fund / maintenance obligations of condo corporations.

- Affordability pressures remain, especially for people priced out of townhouses or single-family homes; the condo market shift may change what kinds of housing are built next.

Bottom Line

For those who own condos in Ontario: you may be riding out some turbulence - lower resale prices, higher carrying costs, and uncertainty - but many of the risks are manageable if you plan carefully. For prospective buyers: there are real opportunities, but also real risks. The key is due diligence, conservative financial planning, and being realistic about long-term holding periods.

Foreign Buyer Ban Update - Good or Bad?

The federal foreign buyer ban, enacted in 2023 and extended to 2027, was intended to make housing more attainable for Canadians. But two years in, experts say it's doing little to curb soaring home prices. Instead, it may be stifling market activity, discouraging developers, and blocking vital international demand that could provide much-needed liquidity to Canadian sellers.

Stifled Demand, Sluggish Market Activity

According to Global News, the foreign buyer ban has been more of a “nuisance” than a market-correcting tool. Re/Max Canada President Christopher Alexander argues that, given the numerous loopholes and exemptions, the ban has had “little to no effect” on the market -impacting just about 2% of buyers. That’s far too small to make a meaningful change either way.

Interestingly, Alexander suggests lifting the ban could actually stimulate activity, giving sellers access to well-financed non-residents - an untapped pool that might help Canadian homeowners in financial distress.

Suppressed Development & Weakened Supply Growth

An expert from Simon Fraser University, Andrey Pavlov, warns the ban may discourage both foreign and domestic investors from funding new housing developments—raising the expected return on investment needed and thus reducing housing supply in the long term.

In B.C., similar measures like the foreign buyers tax and speculation tax were linked with a 7% drop in new building permits, highlighting how such policies can unintentionally hamper vital construction activity.

Minimal Effect on Prices, No Help for Affordability

Royal LePage reports the ban—now extended to 2027—has had virtually no impact on reducing home prices or improving market inventory after two years. The root issue remains the shortage of homes, not foreign purchasers.

Similarly, Global News quotes academic experts who note that foreign buyers only accounted for about 2–4% of purchases in Ontario and B.C. in 2021, making the ban essentially superficial in terms of real market impact.

Political Theatre with Little Practical Value

A Reuters analysis frames the ban’s extension as largely political, intended to signal action rather than enact meaningful change. With foreign ownership already at around 1%, experts say the ban is more performance than policy.

References

Global News – Foreign Buyer Ban Impact 2023 (link)

Global News – Experts on How Ban Affects Housing Market (link)

Royal LePage via MPA Magazine – Ban Fails to Curb Prices or Boost Inventory (link)

Reuters – Canada’s Extension of Ban on Foreign Real Estate Buyers Labelled Political (link)

Global News – Unintended Consequences for Housing Supply (link)

Retiring with Housing Debt

A recent Royal LePage survey finds 29% of Canadians planning to retire in 2025-2026 expect to carry mortgage debt into retirement, which is nearly double the rate from a decade ago. While 45% are mortgage-free (and another 6% expect to be before retirement), housing affordability means many are choosing to either stay in place or downsize - often into condos or 55+ communities - rather than rushing to pay off their homes. CEO Phil Soper notes this shift offers retirees flexibility: whether to support grown children, maintain manageable payments through dividends or part-time work, or simply move at their own financial pace.

✅ Read the full story: The new real estate reality for retirees: Exiting the workforce with mortgage debt

Major Housing Initiatives Under the Carney Government

May 9, 2025

With the recent election of Prime Minister Mark Carney's Liberal government, Canada is poised to implement an ambitious housing agenda aimed at addressing affordability challenges and boosting supply. Here's an overview of the key housing initiatives we can expect:

Build Canada Homes Agency

The Liberals plan to establish a new federal agency, Build Canada Homes, tasked with constructing nearly 500,000 homes annually. This initiative focuses on:

- Utilizing public lands for housing development.

- Investing over $25 billion in financing for prefabricated and modular housing.

- Providing $10 billion in low-cost financing for affordable housing projects.

- Transferring existing affordable housing programs from the Canada Mortgage and Housing Corporation to the new agency.

Public Lands for Homes Plan

To expedite housing construction, the government is unlocking federal properties across the country. As of January 2025, 90 properties have been identified, with the potential to create approximately 1,770 housing units. The goal is to support the construction of 250,000 new homes by 2031. (Canada.ca, Canada.ca)

GST Rebate for First-Time Homebuyers

The Liberals propose eliminating the Goods and Services Tax (GST) on newly built homes purchased by first-time buyers, up to a value of $1 million. This measure aims to reduce the financial burden on new homeowners and stimulate housing supply.

Expansion of Non-Profit and Co-Op Housing

The government plans to double Canada's non-profit community housing, including co-operative housing, by 2035. This initiative involves:

- Investing in innovation and construction productivity.

- Reducing taxes related to building and new construction.

- Expanding skilled trades training to support the increased housing construction.

🏘️ Implications for Canadians

These initiatives represent a significant federal commitment to tackling the housing crisis. By focusing on increasing supply, reducing costs for first-time buyers, and leveraging public lands, the government aims to make housing more accessible and affordable for Canadians.

The Carney government's housing strategy is comprehensive, targeting various aspects of the housing market to address affordability and supply issues. As these policies roll out, their effectiveness will depend on coordination with provincial and municipal governments, as well as engagement with private and non-profit sectors.

Are Factory-Built Homes the Solution to the Housing Crisis?

April 7, 2025

Could Factory-Built Homes Help Solve Ontario’s Housing Crisis? 🏘️

The Ontario Real Estate Association (OREA) thinks so—and they’ve just released a report all about it: Building More, Building Faster.

So, what exactly is a factory-built home?

Also known as modular homes, these are houses that are built in pieces at a factory, then transported to the site and assembled—kind of like giant Lego! Because the building process happens indoors, there are fewer weather delays, less waste, and better quality control. The best part? These homes can go up 30–60% faster than traditional builds.

Why does OREA think this is a game-changer?

With the province aiming to build 1.5 million new homes by 2031, OREA believes factory-built homes could be a key part of the solution. But to make that happen, they’re calling for some important changes, like:

- Updating zoning bylaws so modular homes aren’t lumped in with mobile homes.

- Making sure building codes include national modular housing standards.

- Tweaking transportation rules to make it easier to move modular units.

These changes could help speed up the process and get more affordable, energy-efficient homes onto the market faster.

Bonus: The Ontario government is already on board, committing $50 million to support modular housing innovation.

If you're curious and want to read the full report, you can check it out here: Building More, Building Faster

How the Ontario Real Estate Market is Affected by Consumer Confidence

March 5, 2025

If you’ve been wondering why the housing market seems to be shifting so much lately, one of the key reasons is consumer confidence—or in simple terms, how optimistic people feel about the economy and their own financial future.

What is Consumer Confidence?

Consumer confidence is all about how comfortable people feel spending money. When confidence is high, more people are willing to make big purchases like homes because they feel financially secure. When confidence drops, people tend to hold back, worrying about things like job security, interest rates, and the overall economy.

This directly affects the real estate market—when confidence is up, more people buy homes, pushing prices higher. When confidence is down, buyers take a step back, which can lead to lower prices and slower sales.

What’s Happening in Ontario’s Real Estate Market Right Now?

Ontario's housing market has been on a bit of a rollercoaster lately:

✅ January 2025: Home sales in the Greater Toronto Area (GTA) went up by 10%, with more people listing their homes and prices staying steady. Why? A recent interest rate cut made mortgages more affordable, which encouraged buyers to jump back in.

❌ February 2025: Just a month later, home sales dropped by 28.5%! Why? Concerns over the economy, affordability, and global trade uncertainty made buyers more hesitant. Fewer people listed their homes, and the average price in the GTA dipped to $1,063,300, down 1.8% from last year.

What Does This Mean for You?

🏡 Thinking of Selling? When consumer confidence is high, more buyers are in the market, which can drive prices up. If confidence is low, it might take longer to sell, and pricing your home competitively becomes even more important.

🔑 Looking to Buy? When confidence is low, there’s often less competition, meaning you might have more room to negotiate on price or conditions. If you’re financially stable and mortgage rates are favorable, this could be an opportunity.

Looking Ahead

The Ontario real estate market is closely tied to consumer confidence, and confidence is influenced by everything from interest rates to job security. If you’re thinking about buying or selling, staying informed about these trends can help you make smarter decisions.

Have questions about what’s happening in your neighborhood? Let’s chat—I’d love to help you navigate the market! 🚪🔑

How Might Tariffs Affect the Real Estate Market?

Feb 8, 2025

In today’s interconnected world, the impact of tariffs—taxes placed on imported and exported goods—extends beyond trade negotiations and international businesses. These policies can also influence the real estate market, affecting everything from construction costs to housing prices. Understanding how tariffs could play a role in the housing market helps buyers, sellers, and industry professionals prepare for potential shifts.

What Are Tariffs?

A tariff is essentially a tax on goods coming into a country. Governments impose tariffs to protect domestic industries, encourage local production, or address trade imbalances. While that may sound like an issue reserved for big corporations and international trade deals, tariffs can have very real, on-the-ground effects on the housing market—especially when they impact the cost of materials and investment trends.

Rising Construction Costs

One of the most direct ways tariffs affect real estate is by increasing the cost of building materials. Items like lumber, steel, and concrete are frequently imported, and when tariffs are imposed, their prices rise. This leads to higher costs for builders, who often pass those costs on to buyers in the form of more expensive homes.

In a market already grappling with affordability challenges, higher construction costs could mean fewer new homes being built—particularly in the entry-level market, where profit margins are already tight. This supply crunch could drive up prices, making it even harder for first-time buyers to enter the market.

Effects on Home Prices

With rising construction costs, new home prices typically increase. In turn, buyers may shift their focus to resale properties, driving up demand for existing homes. This could be good news for sellers but could also make affordability an even bigger issue.

On the flip side, if tariffs contribute to broader economic uncertainty or higher costs of living, buyers may hesitate to make big financial decisions like purchasing a home. This could slow down price growth—or in some cases, lead to price corrections in certain markets.

Foreign Investment and Market Shifts

Tariffs don’t just impact local buyers and sellers—they can also influence international investment. When trade tensions rise and tariffs are in play, some foreign investors may be less inclined to put their money into Canadian or U.S. real estate. Cities that typically attract international buyers, such as Toronto or Vancouver, could see a slowdown in foreign demand if tariffs disrupt economic confidence.

At the same time, if tariffs cause financial instability in certain regions, some investors may actually turn to real estate as a safe-haven investment, leading to an increase in activity in specific markets.

Delays and Supply Chain Disruptions

Building a home isn’t just about lumber and steel—it’s also about getting those materials on-site in a timely manner. Tariffs can disrupt global supply chains, causing shortages or delays in key materials. This can slow down construction timelines, leading to fewer homes hitting the market when they’re needed most.

For developers, this uncertainty might make them hesitant to take on large projects, further reducing housing supply and putting additional pressure on prices.

Impact on Consumer Confidence

When tariffs increase the price of everyday goods—from appliances to furniture—consumers start to feel the pinch. If household expenses rise due to higher costs on imported goods, potential buyers may tighten their budgets and put off purchasing a home. This hesitation can create a slowdown in the housing market, especially in regions where affordability is already stretched.

On the other hand, if tariffs lead to more domestic job growth in certain sectors, some areas could see an increase in housing demand as local economies strengthen. It all depends on how trade policies play out over time.

What’s the Long-Term Outlook?

Tariffs and trade policies are always evolving, so predicting their long-term effects on real estate is challenging. If tariffs remain in place for an extended period, we could see lasting shifts in the market—fewer new homes, rising prices for existing ones, and changes in investment patterns.

However, if trade tensions ease and tariffs are lifted, we could see a reversal of some of these trends. Construction costs may stabilize, supply chains could recover, and foreign investment could flow more freely again.

Staying Informed Is Key

While tariffs might seem like an issue for politicians and economists to worry about, they have a ripple effect that can directly impact homebuyers, sellers, and real estate professionals. Keeping an eye on trade policies and market reactions can help you make informed decisions, whether you’re buying, selling, or investing.

As the real estate market continues to adapt to economic changes, staying ahead of these shifts will be essential. Whether it’s through strategic timing, diversifying investment approaches, or simply understanding how tariffs affect housing prices, knowledge is power in an ever-changing market.

Ontario Home Renovation Savings Program

January 7, 2025

Ontario is introducing new energy efficiency programs to help residents and businesses reduce energy consumption and costs. A key initiative is the Home Renovation Savings Program, launching on January 28, 2025, which offers rebates covering up to 30% of expenses for energy-efficient home improvements.

Home Renovation Savings Program

This program provides financial incentives for various home upgrades, including:

- Windows and Doors: Installing energy-efficient models to minimize heat loss.

- Insulation and Air Sealing: Enhancing insulation and sealing to improve energy retention.

- Smart Thermostats: Implementing devices that optimize heating and cooling efficiency.

- Heat Pumps: Adopting efficient systems for heating and cooling.

- Rooftop Solar Panels and Battery Storage: Generating and storing renewable energy on-site.

Eligibility Expansion

With the enactment of the Affordable Energy Act on December 4, 2024, eligibility for these programs has broadened to include homeowners who heat their homes with propane or oil, removing previous restrictions that limited access to those using electric heating.

Additional Support for Small Businesses

The province is also enhancing the Peak Perks program to support small businesses, such as convenience stores and restaurants. Participants can receive a $75 incentive upon enrolment and an additional $20 annually for each eligible smart thermostat connected to their HVAC systems.

Projected Impact

By 2036, these initiatives aim to reduce Ontario's peak electricity demand by 3,000 MW—the equivalent of removing three million homes from the grid. This reduction is expected to save ratepayers approximately $12.2 billion in electricity system costs by avoiding the need for new generation infrastructure.

For more information on these programs and how to participate, visit: Ontario.ca

Stress Test Removed from Uninsured Mortgage Renewals

December 5, 2024

If you’re nearing the end of your mortgage term and dreading the stress test, there’s good news! Recent changes mean that for some homeowners, renewing your mortgage just got easier. Here’s what you need to know:

What Is the Stress Test?

The mortgage stress test is a financial assessment introduced in Canada to ensure borrowers can handle their mortgage payments, even if interest rates rise or their financial circumstances change.

When applying for a mortgage, lenders calculate your ability to afford payments based on either:

- The contract rate (the actual interest rate of your mortgage) plus 2%, or

- The benchmark rate set by the Bank of Canada, whichever is higher.

This ensures borrowers aren’t overextending themselves and adds a safety buffer in case of future financial challenges.

What Has Changed?

The federal government has removed the requirement for lenders to apply the stress test when renewing uninsured mortgages with the same lender. Previously, borrowers had to prove they could handle payments at an interest rate significantly higher than their actual contract rate.

Now, as long as you stay with your current lender, you don’t need to pass the stress test to renew your uninsured mortgage.

Who Does This Apply To?

This change applies to:

Homeowners with uninsured mortgages (typically those who had a down payment of 20% or more when purchasing their home).

Borrowers renewing their mortgage with the same lender.

It’s important to note that this policy doesn’t apply if you switch lenders at renewal. In those cases, the stress test will still apply.

What Does This Mean for You?

Simplified Renewal Process: Staying with your current lender means you won’t need to meet additional financial benchmarks.

More Flexibility: For borrowers with fluctuating incomes or whose financial situations have changed, this could prevent the stress and uncertainty of a renewal application.

Negotiate Rates: Even though you’re not switching lenders, it’s still worth negotiating for a better interest rate or improved terms.

Potential Drawbacks

While this change simplifies renewals, it might reduce your leverage to shop around for the best rate. If you want to switch lenders to secure a better deal, the stress test will still apply.

What Should You Do?

Review Your Options: Always start the renewal process early to explore whether sticking with your lender or shopping around is the better choice.

Consult an Expert: Mortgage brokers can help you weigh the benefits of switching lenders versus staying put.

Plan Ahead: If you think you might want to switch lenders at renewal, focus on maintaining a strong financial profile to pass the stress test.

This policy change is aimed at easing the burden on Canadian homeowners and ensuring they can stay in their homes without unnecessary financial hurdles.

If you have questions about how this impacts your homeownership journey, feel free to reach out. I’m always here to help with advice tailored to your unique situation!

New Mortgage Rules & How it Will Affect the Market

November 10, 2024

Starting December 15, 2024, new mortgage reforms will impact home buyers across Canada, making homeownership more attainable for many—especially in high-cost regions like Toronto and Vancouver. Here’s what these changes mean for buyers, sellers, and the overall real estate market.

30-Year Amortization for First-Time Buyers

Under the new regulations, all first-time home buyers, as well as those purchasing new construction homes, can now access a 30-year amortization period. By spreading the mortgage repayment over a longer time, buyers benefit from reduced monthly payments. For example, a 30-year mortgage on a $500,000 loan with a 5% interest rate results in a monthly payment of $2,684 compared to $2,908 with a 25-year amortization. This lower payment option not only eases monthly expenses but also increases mortgage affordability, allowing more Canadians to qualify under the current stress test requirements.

Higher Insured Mortgage Cap: Up to $1.5 Million

The insured mortgage cap will increase from $1 million to $1.5 million. This adjustment is particularly beneficial for buyers in expensive housing markets where properties are often priced above the former $1 million limit. Now, buyers in regions with higher home prices can qualify for insured mortgages on homes up to $1.5 million with a down payment of less than 20%. This change broadens buying power and allows access to a wider range of properties.

Potential Impacts on the Real Estate Market

These reforms are expected to boost demand in the real estate market, with more buyers able to afford homes they previously couldn’t reach. For sellers, the changes may stimulate more competitive offers, as expanded financing options increase buyer participation, potentially driving up home values in desirable areas.

However, there’s also the possibility of increased property prices as demand rises, especially if housing supply does not keep pace with this new buyer influx. This supply-demand dynamic could lead to further price hikes in high-demand urban markets, affecting affordability for some.

Added Flexibility for Buyers and Investors

For investors, the new rules extend 30-year amortizations to new builds, making it easier to finance construction properties. This flexibility could drive more investment in new developments, a potential boost to housing supply in the long term—a positive response to Canada’s housing shortage.

The Big Picture: Opening Doors to More Canadians

These reforms are part of Canada’s broader housing initiative aimed at increasing access to homeownership while tackling affordability issues. With plans to support the creation of 4 million new homes, the government aims to address Canada’s housing crisis and unlock pathways to homeownership for future generations.

For buyers and sellers alike, these mortgage reforms introduce new opportunities and strategic considerations. As always, it’s essential to consult with a real estate professional to understand how these changes might specifically impact your buying or selling plans.

Feel free to reach out if you’d like to discuss how these changes could affect your real estate journey in 2024 and beyond.

The Cost of Waiting For Interest Rate Drops

October 6, 2024

When the Bank of Canada announces a rate cut, it tends to make headlines across the country, sparking curiosity and excitement. But what do these cuts really mean for homeowners, homebuyers, and anyone looking to get a mortgage? Let’s break it down so you can better understand how these decisions could impact your financial plans.

What is the Bank of Canada Rate?

The Bank of Canada (BoC) sets what’s called the “overnight rate.” This is the interest rate at which banks lend money to each other overnight. Although this doesn’t directly dictate the interest rates we, as consumers, get on mortgages, it heavily influences them.

How Does a Rate Cut Work?

When the BoC cuts the overnight rate, it becomes cheaper for banks to borrow money. In turn, banks may pass these savings along to consumers by lowering the rates on their financial products—most notably, variable-rate mortgages and lines of credit. Lower interest rates mean you pay less in interest on your mortgage, making homeownership more affordable, at least in theory.

How Rate Cuts Affect Variable-Rate Mortgages (or Adjustable-Rate Mortgages)

If you already have a 'variable-rate mortgage', a rate cut could mean immediate savings. Your interest rate may decrease, which lowers your monthly payments or allows you to pay off your mortgage faster. This is because variable-rate mortgages fluctuate with the prime rate, which banks adjust in response to changes in the BoC’s overnight rate. Just how much can you expect to save? A 0.25% rate drop is equal to about $13 per $100,000 in mortgage that you have. That’s it unfortunately. A mere $13 monthly savings.

For prospective buyers considering a variable-rate mortgage, a lower interest rate might make this option more appealing. However, keep in mind that variable rates are subject to change, and if rates go up in the future, your payments could increase.

What About Fixed-Rate Mortgages?

Fixed-rate mortgages are a bit different. These rates are influenced by the bond market rather than the BoC’s overnight rate. However, a rate cut can still have an indirect effect on fixed-rate mortgages. When the overnight rate is cut, the bond market can respond by lowering yields, which may lead to lower fixed mortgage rates in the long term. This isn’t always immediate, and fixed rates tend to move less dramatically than variable rates.

If you’re locking in a fixed-rate mortgage, a BoC rate cut may not give you instant savings, but you might see rates trend down in the weeks or months following the announcement.

Waiting for Rate Cuts to Save Money on Housing

Perceived lower borrowing costs tends to encourage more people to buy homes, which increases demand and can push prices higher, especially in competitive markets like Kitchener-Waterloo. This is great for Sellers, but not so much for Buyers.

Home prices continue to go up without the strain of increased buyer demand. The amount you can pay for a house today, can alter by thousands to tens of thousands of dollars each and every month. A heated market caused by increased buyer demand can drive home prices to increase weekly. Unless you are able to increase your downpayment, increased house costs means a larger mortgage and less affordability.

Should You Wait to Buy?

Regardless if you are planning on getting a variable-rate or fixed-rate mortgage, the cost of waiting for interest rate drops could potentially mean paying a lot more for a home. If all want-to-be homeowners have the same thought, then you even risk being bumped out of being able to afford the style of home you want, due to mass multiple bid scenarios driving prices higher.

Bottom line, make sure you are partnered up with professional and trustworthy mortgage and real estate agents, to get the full picture on how much you buying a home today versus tomorrow might cost you.

Canada Greener Homes Initiative

September 1, 2024

The Canada Greener Homes Loan is an excellent initiative designed to support homeowners in making energy-efficient upgrades to their properties. By offering up to $40,000 in interest-free loans, this program helps Canadians invest in home improvements that not only enhance comfort and livability but also contribute to long-term savings on energy bills. Upgrades like better insulation, high-efficiency windows, and modern heating systems can transform a home, making it more enjoyable to live in and extending its lifespan.

Additionally, these improvements can significantly boost a home's market value, making it a more attractive option for potential buyers. Energy-efficient features are increasingly sought after, and homes with such upgrades often command higher resale prices. With the Canada Greener Homes Loan, homeowners can undertake essential renovations now and benefit from a more valuable and efficient property when they decide to sell.

Learn more about the loan: Canada Greener Homes Loan

Check out eligible retrofits: Eligible retrofits and grant amounts

Mortgage Renewal Options - With Tim Bloomfield

August 8, 2024

When it comes time to renew your mortgage, you're faced with a crucial decision that can significantly impact your financial future. Whether you're looking to secure a better rate, access your home's equity, or simplify your payments, understanding your options is key. Here’s a breakdown of the three main choices you have when renewing your mortgage: signing with your current lender, transferring to a new lender, or refinancing with either your current or a new lender.

The Three Options for Mortgage Renewals

Sign with Your Current Lender

Sticking with your current lender can be the simplest and most straightforward option. Every lender has its own process and timeline, so it’s essential to pay attention to the renewal paperwork they send out, typically around four months before your renewal date. The biggest advantage of renewing with your current lender is that you avoid the need to requalify for your mortgage. This means less paperwork, fewer headaches, and a quicker renewal process.

Transfer to a New Lender

If you’re looking to save money, transferring your mortgage to a new lender could be the way to go. This option often allows you to combine your mortgage with a secured line of credit into one easy payment. Plus, new lenders tend to offer the best and lowest rates, and they typically cover the costs of legal fees and appraisals, making this an attractive option. However, it’s important to note that transferring to a new lender may not be the best choice if you have a high level of debt, as you’ll need to requalify for the mortgage. If your original mortgage was insured, you can requalify using the contract rate for the stress test, which might ease some concerns.

Refinance with Your Current or a New Lender

Refinancing is a smart move if you’re looking to consolidate debt or access your home’s equity. While refinancing typically comes with higher interest rates compared to renewals or transfers, it offers the flexibility you might need to achieve your financial goals. Like with transferring, you’ll need to requalify for the mortgage, but the benefits of consolidating your debt or unlocking your home’s equity might outweigh the higher rates.

Choosing the right option for your mortgage renewal is a decision that should be made carefully, considering your financial situation and long-term goals. Whether you choose to stay with your current lender, transfer to a new one, or refinance, understanding the pros and cons of each option will help you make the best choice for your future.

If you have questions about what your best option might be, connect with Tim Bloomfield for expert advice:

tim.bloomfield@valkofinacial.ca

(519) 497-0512

The Impact of Recent Capital Gains Tax Increase in Canada on Cottage and Second Home Owners

June 30, 2024

The Canadian government has recently implemented an increase in the capital gains tax, a move that has sparked significant concern among property owners, particularly those with cottages, investment properties, or second homes. While this tax change is aimed at generating additional revenue, it also has substantial implications for regular Canadians who may not see themselves as traditional investors.

UNDERSTANDING CAPITAL GAINS TAX

Capital gains tax is a levy on the profit realized from the sale of a non-primary residence, such as a cottage, second home, or investment property. The gain is calculated as the difference between the purchase price and the sale price of the property, with adjustments for certain expenses.

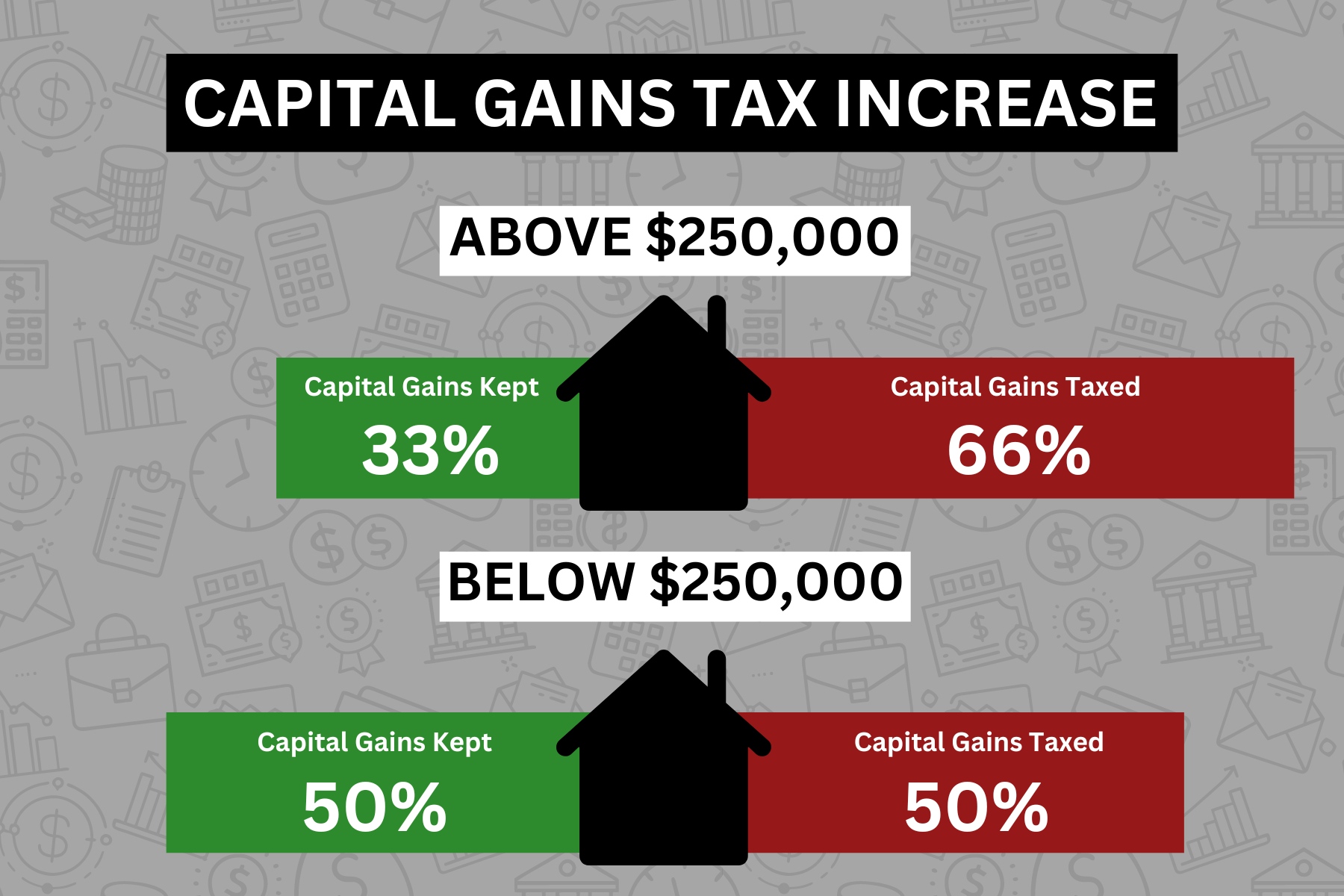

THE RECENT TAX INCREASE

The recent change involves increasing the inclusion rate for capital gains tax. Previously, a straight 50% of the capital gain was taxable. As of June 25, 2024, however, you will be taxed on 50% of your annual capital gains up to $250,000. For any capital gains over $250,000, that ratio increases to two-thirds, or approximately 66.67%. This means that more of the profit from the sale of these properties will be taxed, resulting in a higher tax burden for property owners.

IMPACT ON REGULAR CANADIANS

Cottage Owners

Generational Impact: Many Canadians own cottages that have been in their families for generations. The increased tax burden can make it more challenging to keep these properties within the family. Selling the cottage to cover the tax bill might become a necessity, disrupting family traditions and heritage.

Increased Costs: For those looking to sell their cottage, the increased tax means a significant portion of the proceeds will go to taxes, reducing the funds available for other uses, such as retirement savings or funding children’s education.

Second Home Owners

Retirement Planning: Many Canadians purchase second homes as part of their retirement plan, expecting to sell them for a profit. The higher capital gains tax can eat into these profits, affecting the financial security of retirees.

Affordability: The increased tax might deter potential buyers, leading to a slower market for second homes. This could result in lower sale prices, further reducing the expected return on investment. A good example of that is what is currently occurring in the condo apartment market.

Investment Property Owners

Reduced Profit Margins: Regular Canadians who have invested in rental properties for additional income will see a reduction in their profit margins due to the increased tax. This might lead some to reconsider the viability of maintaining these investments.

Market Dynamics: With the increased tax burden, there might be fewer properties on the market as owners hold onto their investments longer to avoid the tax hit. This could reduce the supply of rental properties, potentially driving up rents and affecting the rental market.

SHOULD YOU SELL?

The decision to sell in light of the increased capital gains tax depends on individual circumstances. Here are a few considerations:

Financial Goals: Assess your financial goals and the role your property plays in achieving them. If the property is essential for your retirement plan or income, holding onto it might still make sense.

Tax Planning: Consult with a tax advisor to explore strategies for minimizing the tax impact. This could include timing the sale to coincide with lower income years or exploring exemptions and deductions that might apply.

Market Conditions: Consider the current real estate market conditions. If property values are high, selling now might still yield a significant profit even after taxes. Conversely, if the market is slow, it might be worth holding onto the property until conditions improve.

CONCLUSION

The recent increase in capital gains tax in Canada presents a new challenge for regular Canadians who own cottages, second homes, or investment properties. While the tax hike is aimed at generating revenue, it has the potential to impact family traditions, retirement plans, and the overall financial well-being of many. Careful consideration of personal financial goals, market conditions, and strategic tax planning can help mitigate some of the effects of this increased tax burden. Consulting with financial and tax advisors is crucial to making informed decisions about whether to sell or hold onto these properties in the current economic climate.

Bank of Canada Cuts Key Interest Rate to 4.25%

June 9, 2024

The BOC cut the key interest rate for the first time since the pandemic, and is even suggesting there may be more cuts coming. What does this mean for you? Depending if you are on the buying side or selling side of a house sale, this is how you may be impacted:

FOR BUYERS

Lower Mortgage Rates

Affordability: With the cut in the key interest rate, mortgage rates offered by banks and other lending institutions are likely to decrease. This means lower monthly payments for homebuyers, making real estate more affordable.

Qualification: Lower rates improve buyers' debt-to-income ratios, potentially allowing more individuals to qualify for mortgages and enabling buyers to afford more expensive homes than they could previously.

Increased Purchasing Power

Bigger Budgets: Buyers can leverage the lower rates to stretch their budgets further. This might allow them to consider properties that were previously out of reach.

Investment Opportunities: Lower borrowing costs can make real estate investments more attractive, encouraging more people to buy properties for rental income or capital appreciation.

Market Competition

More Buyers: The lower rates are likely to attract more buyers into the market, increasing competition for homes. This can be particularly intense in markets where housing supply is already tight.

FOR SELLERS

Higher Demand

Increased Buyer Interest: As more buyers enter the market due to more affordable mortgage rates, sellers may see heightened interest in their properties, potentially leading to quicker sales.

Competitive Offers: Higher demand can result in multiple offers on properties, often leading to bidding wars, which can drive up the final sale price.

Potential for Price Appreciation

Rising Home Prices: The increase in demand typically puts upward pressure on home prices. Sellers might be able to command higher prices for their properties, benefiting from the competitive market environment.

Faster Transactions

Quicker Sales: With more buyers eager to capitalize on lower rates, homes may spend less time on the market. This can be advantageous for sellers looking for swift transactions.

GENERAL IMPACT ON THE REAL ESTATE MARKET

Economic Stimulus

The rate cut is intended to stimulate economic activity, and the real estate sector is a significant part of the economy. Increased activity in real estate can have a positive ripple effect, boosting related industries such as construction, home improvement, and real estate services.

Inventory Challenges

Supply Constraints: If the supply of homes doesn’t keep up with the increased demand, it can lead to inventory shortages. This might make it harder for buyers to find suitable homes and could contribute to further price increases.

Inflation Considerations

While the rate cut aims to boost the market, it may also lead to higher inflation. This could impact the real estate market by increasing the costs of building materials and labor, potentially affecting new construction and renovation projects.

SUMMARY

The Bank of Canada’s interest rate cut to 4.25% is poised to significantly influence the real estate market. Buyers will benefit from lower mortgage rates and increased affordability, which could allow them to purchase more expensive homes or enter the market for the first time. Sellers, in turn, are likely to see increased demand, potentially higher sale prices, and quicker transactions. However, these changes may also bring challenges such as increased market competition and potential inventory shortages, along with broader economic impacts like inflation.